With hundreds of Forex signal providers available to choose from, traders need to pay attention to all details, as often the slightest nuances determine which signal provider is the best. In this article, we’ll show what a Forex signal service is and what you need to look for when picking one to get the best Forex signals on the market. In addition, we’ll cover how to use and filter through the signal services that come included with MetaTrader 4 and 5.

What is a Forex signal service?

Let’s first start with the basics. A Forex signal provider is a service, usually on a subscription basis, where a provider sends regular trading signals to subscribers to trade on. This means that a good Forex signal provider does all the hard work of analysing the market and finding suitable trade setups, which are then sent out in the form of signals to the subscribers.

Those signals usually include the traded instrument with the entry price, stop loss, and take profit levels, but can also include additional information like charts and various market commentaries.

Signals are usually offered through various subscription models, including monthly and yearly packages, where the latter usually comes with a heavy discount of the monthly rate. While the price and the subscription model depends on the signal provider, rates usually begin at around $50 and can reach up to a few hundred dollars.

1. Look for profitability and verified track records

Naturally, one of the most important characteristics of a Forex signal service is its profitability. And while all signal providers claim to be very profitable, there is only one thing that you should look for – a verified track record. Verified track records ensure that all signals that are sent out are also taken by the signal provider itself, which builds trust among subscribers.

The profitability of Forex signals is measured in pips, just like any other Forex trade. Most signal providers list their monthly profitability on their website, and sometimes also include a trade history with the traded instruments. In any case, don’t go for a signal provider that doesn’t have a verified track record.

The best option is to look for third-party verification services, such as myfxbook.com. The picture above highlights what you need to look for on the provider’s myfxbook link: make sure the account is Real (USD), and that “Track Record Verified” is checked.

If the provider doesn’t showcase a myfxbook link on its website, or a similar third-party service, traders can’t tell for sure that the stated profits are real.

2. Apply for a trial period

Since the best Forex signal services don’t have to hide anything, they will usually offer free trial periods for potential subscribers who want to test their signals. If there’s a possibility to apply for a trial period, always do so before paying the monthly subscription rate.

Trial periods are great for a number of reasons. Not only do they offer a free way to test the signals, but you can also check whether the format of the signals suits your trading style, the time the signals are sent out, and whether there are any additional materials that accompany the signals, such as charts and trade commentary. These nuances can really help you figure out which one best suits you, so make sure to pay attention to all the details.

If a trial period is offered by a Forex trading signal provider, the average duration of the trial is usually one to two weeks. While this may come along as a short period at first, it offers still enough time to build confidence in the provider and its signals.

3. Check the provider’s time zone

Even the best Forex trading signals won’t make a large difference to your trading performance if they’re sent out while you're asleep. You won’t be able to open trades based on the signals, or you may simply miss a lot of profits on the initial move if you open the signals with a delay of a few hours. That’s why checking the time zone and times at which the signals are sent out is vitally important before signing up for a Forex signal service.

Signing up for a trial period, as mentioned above, can help you determine the usual times the signals are sent out. If you receive most of the signals after midnight, chances are you’ll be better off with a completely different signal provider.

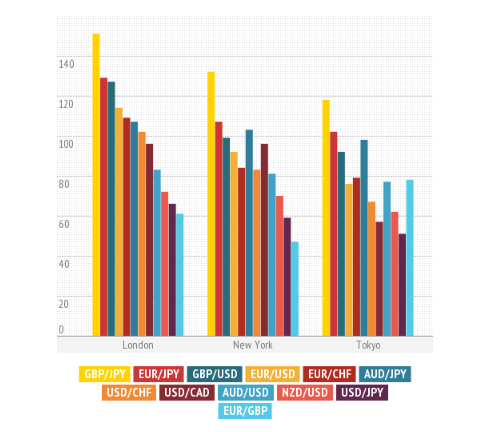

That being said, if the provider is focused on shorter-term, intraday signals, the most volatile part of the day is the overlap of the London and New York trading sessions. Check the following chart to see the average volatility of pairs per Forex trading session. The best Forex trading signal provider needs to take these trading hours into account when sending its trading signals out.

4. Do the signals suit your trading style?

Another important point to consider is the style of the signals. Are they short-term or long-term signals? Are they based on fundamentals, technicals, or a combination of both? Do they trade intraday breakouts, or medium-term price swings? All of this can have a significant impact on the success rate and profitability of the signals.

Good Forex signals have to be profitable first and foremost, regardless of the trading style. But, in the long run, you’ll feel more comfortable trading signals that suit your personal trading style, and in fact, you may also learn along the way. If you’ve never been a scalper, don’t subscribe to a signal provider that sends out dozens of short-term signals throughout the day. If you don’t want to stick in front of your trading platform all day, go for longer-term trading signals instead.

Longer term signals usually have a higher success rate on average, compared to shorter-term ones. However, in the end it’s all about the actual profitability of the signals and whether you’re comfortable with the provider’s trading style.

5. Signal charts and analysis

While the most basic signals are sent out with the entry price, stop loss, and take profit levels, the top Forex signals also include additional material such as charts and market analysis that accompany the signal. Traders may feel reluctant to open trades based on signals that don’t explain why a particular trade should be opened.

Charts that are sent out by signal providers usually show a technical setup with major support and resistance zones, based on which stop loss and take profit levels are determined. In addition, a description of the setup that includes fundamental factors shows that the provider doesn’t rely purely on technical analysis.

Charts and market commentary can also be used to learn more about the Forex market by yourself, which is mandatory if you want to become an independent and successful Forex trader in the future. Don’t blindly follow a signal based only on provided entry and exit points – additional materials are a characteristic of the best Forex trading alerts.

6. Additional support

Additional support shows that the signal provider cares about its subscribers. The kind of support is usually listed on the provider’s website, so make sure to double check all shortlisted providers on their additional trading support. This can include trading videos, webinars, or a weekly or daily market outlook or watch list that includes a list of currency pairs that the provider wants to trade.

In addition, customer support shouldn’t be neglected when picking a signal provider. If you have any questions regarding trade setups and signals, the best Forex signals service providers should answer all of them. Look for options to directly contact the provider, either via email, WhatsApp, or Telegram.

7. Shortlist and compare signal service providers

After you've made clear what you’re looking for in a signal provider, you need to shortlist and compare their Forex signals. There are many websites which rank Forex signal providers, and a simple Google search will find plenty of them.

When researching a Forex signal providers ranking, focus on the top 10 providers on the list and check that they meet all necessary points covered in this article. Pick a few of them that offer trial periods, subscribe to the trials, and compare the performance of their signals, the times at which the signals are sent out, their trading style, and any other component that you may find important.

You may also find free Forex signal services on those lists, but be aware that those services usually try to sell other products to their subscribers, such as trading courses or Expert Advisors. Their signals don’t have to be necessary bad, so make sure to read through the best free Forex signal reviews before signing up for one and risking your money on their signals.

How to find an MT4/5 signal provider?

If you’re using MetaTrader 4 or 5 as your trading platform, you can choose among dozens of signal providers directly inside MetaTrader. The great thing about this is that you don’t have to wait for a signal to arrive in order to open it manually, as your trading platform will do it automatically for you.

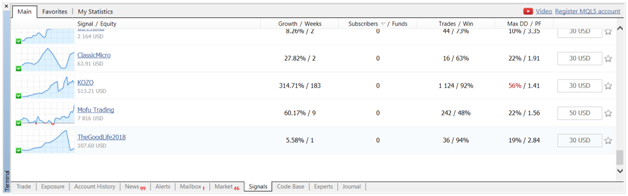

To find the signal providers inside MetaTrader 4 or 5, you need to go to the Terminal window (called Toolbox in MetaTrader 5), and select the Signals tab.

This will open a list of signal providers with a handy screenshot of their trading performance in the far left column, followed by their name, the growth, the number of weeks needed to achieve that growth, the number of subscribers and total funds under management, the number of trades taken and their win rate, and the maximum drawdown and profit factor (in trading, maximum drawdown refers to the distance between the highest and lowest points of a trading account).

In the far-right column, you can find the price of a monthly subscription.

After you find an interesting signal services provider from the list, simply click it to learn more about its system. In addition to a short description of the provider, you’ll find detailed performance charts such as growth charts, equity and balance charts, and reviews from previous subscribers. Make sure to read through all of the reviews before subscribing to any of these signal services.

In the description section, pay attention to the style of the signals. Many signal providers inside MetaTrader are simple EAs that don’t use human input when opening, managing, and closing trades. While this can work great during certain market conditions, their performance can suffer when the market environment changes and there is no real trader behind the signals who would adjust them accordingly.

Some signal providers that you can find inside the MetaTrader platform are real human traders who analyse the market and send their setups in the form of trading signals. This is still not a guarantee for success, so make your research of the performance charts and read through reviews of existing subscribers before signing up with a provider.

Final words: What is the best Forex signal provider?

In this article, we covered the main points that you need to follow to find the best Forex alerts on the market. Naturally, the best Forex signal provider has to be profitable in the first place and have a verified track record, ideally by a third-party provider such as myfxbook. However, you need to pay attention to the details as well and ask yourself the following questions: when are the signals sent out, do they match your trading style, and is there a trial period to check the signals before signing up for a subscription?

The best Forex signals come with additional charts and market commentary that accompany the signal itself. This additional material can also be used as a great educational resource to learn from, especially if you’re looking to become a Forex trader yourself.

A top Forex signals services provider should also provide support for subscribers. Whether you have concerns about the signals or the charts and commentary, the provider shouldn’t mind answering all of your questions.

Finally, the MetaTrader platform can also be used to find a signal provider. Simply go the Signals tab in the Terminal window, and you’ll find a detailed list of signals with a description, performance charts, and subscriber reviews. Just follow our tips outlined in this article, and picking your next best Forex signal provider will be a piece a cake.

ZuluTrade is arguably the biggest and the best site to use if you are looking for profitable signals because they currently have more than 100,000 traders that you can subscribe to, and best of all, there are no monthly fees because it is completely free.

ZuluTrade is arguably the biggest and the best site to use if you are looking for profitable signals because they currently have more than 100,000 traders that you can subscribe to, and best of all, there are no monthly fees because it is completely free. Several brokers have been looking to capitalize on the popularity of social / copy trading in the last few years, and FTXM Invest is one of the more popular copy trading programs.

Several brokers have been looking to capitalize on the popularity of social / copy trading in the last few years, and FTXM Invest is one of the more popular copy trading programs. Marketclub is another service that you can use if you are looking for some reliable forex signals. Indeed they actually offer signals for stocks, commodities, options, futures and ETFs as well, which means that you have many more ways to find profitable trading opportunities.

Marketclub is another service that you can use if you are looking for some reliable forex signals. Indeed they actually offer signals for stocks, commodities, options, futures and ETFs as well, which means that you have many more ways to find profitable trading opportunities. Ayondo offers an award-winning trading platform for spread betting and CFDs, but they also offer a social trading platform so that you can make money from the signals of other successful traders and investors.

Ayondo offers an award-winning trading platform for spread betting and CFDs, but they also offer a social trading platform so that you can make money from the signals of other successful traders and investors. One final service that I want to recommend is Traders Academy Club because although this isn’t strictly speaking a signal service, you do get detailed trading reports every day with the latest profitable set-ups.

One final service that I want to recommend is Traders Academy Club because although this isn’t strictly speaking a signal service, you do get detailed trading reports every day with the latest profitable set-ups.